Long term investment planning refers to the process of developing and implementing a strategy to achieve financial goals over an extended period, typically spanning several years or even decades. It involves thoughtful consideration of one financial objectives, risk tolerance, and time horizon, with the aim of building wealth and securing financial stability for the future.

Key Aspects of long term investment planning include:

- Setting Financial Goals: Long term investment planning begins with defining specific financial goals, such as retirement savings, funding education expenses, purchasing a home or achieving financial independence. These goals serve as a roadmap for the investment strategy and help determine the appropriate investment vehicles and asset allocation.

- Risk Assessment and Tolerance: Assessing risk tolerance is crucial in long term investment planning investors need to evaluate how much volatility and uncertainty they are willing to tolerance in pursuit of higher returns. Understanding risk tolerance helps determine the appropriate mix of assets in the investment portfolio to balance potential returns with the level of risk.

- Asset Allocation Strategy: Asset allocation involves diving investment funds among different asset classes, such as stocks, bonds, real estate and cash equivalent based on the investor’s financial goals, risk tolerance, and time horizon. A well diversified portfolio spread across multiple asset classes can help reduce risk and maximize returns over the long term.

- Investment Selection: Long term investment planning entails selecting specific investment that align with the chosen asset allocation strategy and financial goals, This may include individual stocks, bonds, mutual funds, exchange traded funds, real estate properties, or alternative investments, depending on factors, such as investment objectives, risk tolerance, and market conditions.

- Regular Review and Adjustment: Long term investment planning is not a one time activity but an ongoing process that requires regular review and adjustment. Market conditions, economic factors, and personal circumstances may change over time, necessitating modification to the investment strategy. Regular portfolio reviews help ensure that the investment plan remains aligned with the investor’s goals and objectives.

- Patience and Discipline: Successful long term investment planning requires patience and discipline markets may experience fluctuations and volatility in the short term, but a long term perspective helps investors stay focused on their goals and avoid making impulsive decisions based on short term market movements

Long term investment plans with high returns

Long term investment plans with high returns aim to generate substantial growth in wealth over an extended period while minimizing the associated risks. While there are no guarantees in investing , certain strategies and investment vehicles are commonly associated with the potential for higher returns over the long term.

- Stock Market Investment: Investing in the stock market has historically provided some of the highest returns among various asset classes over the long term. Stocks offer the potential for capital appreciation as companies grow and increases their profits. However. Investing in individual stocks can be risky, so diversification through mutual funds, exchange traded funds, or Index funds is often recommended.

- Equity Mutual Funds or ETFs: Equity mutual funds and ETFs invest in a diversified portfolio of stocks across different sectors and industries. These funds offer exposure to the potential growth of the stock market while spreading risk across multiple companies. Growth oriented funds or those focusing on emerging markets may offers higher returns over the long term, albeit with higher volatility.

- Real Estate Investment Trusts: REITs are companies that own and manage income generating real estate properties, such as commercial buildings, apartments or shopping centers. Investing in REITs provides exposure to the real estate market’s potential for capital appreciation and rental income, offering diversification and potential high returns over the long term.

- Small Cap and Mid Cap Stocks : Small cap and mid cap stocks represent shares of smaller companies with higher growth potential compared to large cap stocks. Investing in these stocks can offer higher returns over the long term, albeit with increased volatility and risk. Research and careful selection of small cap mid cap companies with strong growth prospects are essential for success.

- Emerging Markets: investing in emerging market economies such as those in Asia, Latin America, or Africa , can provide opportunities for high returns over the long term. Emerging markets often experience rapid economic growth, driven by factors such as demographic trends, urbanization, and increasing consumer spending. However investing in emerging markets carries higher risk due to factors like political Instability, currency fluctuations, and less developed regulatory environments.

- High Growth Sectors and Industries: Investing in high growth sectors and industries, such as technology, healthcare, or renewable energy, can offer potential for above average returns over the long term. Companies operating in these sectors may experience rapid growth and innovation, leading to significant capital appreciation for investors. However, investing in high growth sectors also entails higher volatility and risk.

Long term investment planning in India

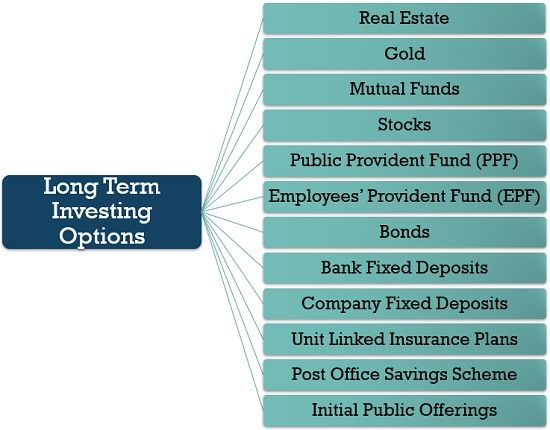

Long term investment planning in India involves developing a strategic approach to building wealth and achieving financial goals over an extended period, typically spanning several years or decades. India offers a diverse range of investment opportunities across various assets classes, each with its own potential growth and risk considerations.

- Mutual Funds: Mutual funds are popular investment vehicles in India, offering diversification across a range of asset classes, including equities, bonds and money market instruments. Equity mutual funds, particularly those with a focus on large cap or diversified portfolio, can provide exposure to the growth potential of Indian companies while managing risk through diversification.

- Public Provident Fund (PPF): The public provident fund is a long term savings scheme backed by the Indian government offering tax benefits and attractive interest rates. PPF accounts have a lock in period of 15 years and can be extended in blocks of five years thereafter. PPF is considered a safe and reliable investment option for long term wealth accumulation and retirement planning.

- National pension System (NPS): The National pension system is a voluntary retirement savings scheme regulated by the Pension Fund Regulatory and Development Authority (PFRDA). NPS offers tax benefits and a choice of investment options, including equities, corporate bonds, and government securities. It is designed to provide regular income during retirement and is suitable for long term retirement planning.

- Real Estate: Real Estate investment is a popular choice for long term wealth creation in India. Investing in residential or commercial properties can offer capital appreciation and rental income over time. However, real estate investment require careful due diligence and consideration of factors such as location, market trends, and legal regulations.

- Gold and Precious Metals: Gold has long been considered a store of value and a hedge against inflation in india. Investors can purchase physical gold in the form of jewelry or gold coins, invest in gold exchange traded funds, or opt for sovereign gold bonds issued by the government . Gold investments can serve as a diversification tool in a long term investment portfolio.

- Systematic Investment Plans (SIP): SIP allow investors to regularly invest a fixed amount in mutual funds over time helping to average out market fluctuations and benefit from the power of compounding. SIP are convenient and disciplined way to invest in mutual funds for long term wealth creation.

Long term investment plan for child

Planning for a child future involves considering various financial aspects, including education expenses, marriage costs, and long term financial security.

- Education Fund: Start by setting up a dedicated education fund to cover the cost of your child’s higher education. Consider investing in education specific investment options such as education savings plan or mutual funds designed to grow funds over the long term while offering tax benefits.

- Child Insurance Plan : Consider purchasing child insurance plans that provide a combination of insurance coverage and investment benefits. These plans typically offer maturity benefits that can be used for the child ‘s education or other future needs.

- Sukanya Samriddhi Yojana (SSY) : If the child is a girl, consider opening a sukanya samriddhi yojana account, which is a government backed savings scheme aimed at promoting the girl child’s education and marriage. SSY offers tax benefits and attractive interest rates, with a maturity period 21 years.

- Gold Investments: Allocate a portion of the child’s portfolio to gold investments to hedge against inflation and provide stability. Options include physical gold, gold ETFs, or sovereign gold bonds, which offer the benefit of capital appreciation over the long term.

- Term Insurance for Parents: Ensure adequate term insurance coverage for parents to protect the child’s financial future in the event of unforeseen circumstances. Term insurance provides a lump sum payout to the child in case of the parent’s demise, ensuring financial stability for the child’s upbringing and education.

Long term investment plans in stocks

Long term investment plans in stocks involve strategic allocation of funds into equities with the goal of achieving significant capital growth over an extended period, typically spanning several years of decades.

Set Long Term Goals: Define your financial objectives and time horizon for investing in stocks. Whether it’s saving for retirement, funding education expenses, or building wealth over the long term, having clear goals will guide your investment strategy.

Risk Assessment: Evaluate your risk tolerance to determine how much volatility and market fluctuations you can tolerate.. Stocks can be volatile in the short term, but historically, they have provided higher returns compared to other asset classes over the long term.

Research and Analysis: Conduct thorough research and analysis to identify high quality companies with strong fundamentals, sustainable competitive advantages, and solid growth potential. Consider factors such as revenue growth, earnings growth, profitability, an management quality when selecting stocks for your portfolio.

Buy and Hold Strategy: Adopt buy and hold strategy for long term investing in stocks. Resist the temptation to time the market or engage in frequent trading, as this can lead to higher transaction costs and lower returns. Instead, focus on investing in fundamentally sound companies an holding on to theme for the long term.

Reinvest Dividends: Reinvest dividends received from stocks back into the same companies or other investment opportunities to take advantage of the power of compounding. Reinvesting dividends can significantly enhance long term returns and accelerate wealth accumulation over time.

Stay Informed: Stay informed about market trends, economic indicators and industry developments that may impact your stock investments. Keep abreast of company news and earnings reports to make informed decisions about buying holding, or selling stocks in your portfolio.

Seek Professional Advice: Consider seeking professional advice from a financial advisor or investment expert to help you develop and implement a long term investment plan tailored to your specific goals, risk tolerance, and financial situation.