Tax planning strategies refer to the deliberate and proactive actions taken by individuals and businesses to minimize their tax liabilities and optimize their financial situation with in the frame work of applicable tax laws and regulations. These strategies involve analyzing financial circumstances, assessing tax implications, and implementing tactics to legally reduce the amount of taxes owed.

Tax Planning strategies may include various approaches and techniques tailored to specific financial goals and situations. Some common tax planning strategies are.

Income Deferral: Delaying the receipt of income until a later tax year to reduce current tax liabilities. This can involve deferring bonuses, income from investments,or self employment icome.

Expense Acceleration: Bringing forward deductible expenses into the current tax year to increase deductions and reduce taxable income. Examples include prepaying mortgage interest, property taxes, or business expenses.

Investment Planning: Structuring investment portfolios to maximize taxes on investment income and capital gains. Strategies may involve investing in tax efficient vehicles such as retirement accounts, municipal bonds, or tax advantaged accounts.

Retirement Planning: Utilizing retirement savings accounts such as IRAs, or SEP-IRAs to defer taxes on contributions and earnings until retirement. Contributions to these accounts may be tax deductible, reducing current tax liabilities.

Health Care Planning: Taking advantage of tax advantaged healthcare accounts such as health savings accounts (HSAs) or flexible spending accounts(FSAs) to pay for qualified medical expenses with pre tax dollars, reducing taxable income.

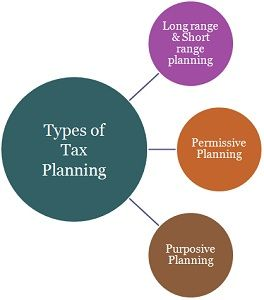

Types of tax planning strategies

Types of tax planning strategies some are:

- Investment in Tax Saving Instruments: Individuals can invest in various tax saving instruments such as public provident fund (PPF), equity linked saving scheme(ELSS), national saving certificate (NSC), and tax saving fixed deposits to avail deduction under section 80c the income tax act.

- Maximizing Deductions: Taxpayers can maximize deductions available under various sections of the icome tax act, such as section 80D health insurance premium.

- Housing Lona Benefits: Individuals can avail tax benefits on housing loans by claiming deductions on both principal repayment and interest payment for self occupied or rented properties.

- Utilizing Capital Gains Exemptions: Taxpayers can utilize exemptions available on captial gains by investing in specified assets such as residential property or specified bonds under section 54. of the income tax act.

- Optimizing Salary Structure: Employees can structure their salary components effectively to minimize tax liabilites by maximizing exemptions and deductions available for allowances such as house rent allowance (HRA), leave travel allowance (LTA), and medical reimbursements.

- Tax Planningfor Business Entities: Businesses can adopt tax efficient business structure, such as limited liability partnership (LLPs)or private limited companies, to optimize tax liabilities and avail benefits such as lower corporate tax rates, tax incentives, and deductions for business expenses.

- Advance Tax Planning: Individuals and businesses can plan their tax payments in advance by estimating taxable income and paying taxes in installments to avoid interest and penalties for underpayment of taxes.

- Setting Off Losses: Taxpayers can set off losses incurred in one source of income against gains form another source to reduce overall tax liabilites. Losses from business, capital gains, or house property can be set off against taxable income from other sources.

Tax planning strategies for high income earners

Tax planning strategies for high income earners aim to minimize taxs liabilities while maximizing after tax income wealth accumulation.

- Qualified Small Business Stock: Consider investing in qualified small business stock if eligible, as gains from the sale of QSBS held for at least five years may be eligible for exclusion from federal income tax under certain conditions.

- Income Shifting and Splitting: Consider income shifting or splitting strategies if applicable, such as gifting income or assets to family members in lower tax brackets, establishing trusts,or utilizing family partnerships to distribute income among family members.

- Real Estate Investments: Explore real estate investments, such as rental properties or real estate investment trusts (REITs), which offer tax advantages such as depreciation deductions, capital gains treatment, and potential tax deferral through like king exchanges.

- Estate Planning: Develop an estate plan to minimize estate taxes and facilitate the transfer to wealth to heirs or beneficiaries. Strategies may include establishing trusts, leveraging lifetime gifting, utilizing estate tax exemptions, and considering charitable bequests.

- Utilizing Tax Credits: Take advantage of available tax credits, such as the child tax credit, education tax credit, or residential energy efficiency tax credit, to reduce tax liabilities dollar for dollar.

- Tax Loss Harvesting: Offset capital gains with capital losses by strategically selling investments that have experienced losses. Capital losses can be used to offset capital gains, reducing over all tax liabilities.

- Investing In Tax Deferred Annuities: Consider investing in tax deferred annuities to defer taxes on investment gains until withdrawals are made in retirement. Tax deferred annuities provide away to accumulate wealth while minimizing current tax liabilities.

- Utilizing Health Savings Accounts: Contribute to an HSA if eligible, as contributions are tax deductible, and withdrawals for qualified medical expenses are tax free. HSAs offer a triple tax advantage contributions are tax deductible, earnings grow tax free, and withdrawals for qualified medical expenses are tax free.

Tax planning strategies for companies

Tax Planning Strategies for companies involve various approaches and techniques aimed at minimizing tax liabilities while maximizing after tax profits with in the frame work of applicable tax laws.

Here are some common tax planning strategies for companies.

Capital Expenditure Planning: Leveraging tax incentives and deductions avilable for capital expenditure to minimize tax liabilities. Companies can take advantage of accelerated depreciation, bonus depreciation, or section expensing to reduce taxable income.

State and Local Tax (SALT) Planning: Managing state local tax liabilities through strategic planning and compliance with state specific tax regulations. This may involve considering factors such as nexus, apportionment, and state tax credits or incentives.

Dividend and Distribution Planning: Structuring dividends and distributions to shareholders in a tax efficient manner, considering factors such as qualified dividends, capital gain distributions,and dividend imputation credits.

Tax Loss Utilization: Leveraging tax loss carryforward or carrybacks to offsset current or future taxable income. Companies can utilize net operating loss deductions to reduce tax liabilities in prfitable years or cary losses back or forward to offset taxes in other years.

Employee Benefit Planning: Offering tax advantaged employee benefit plans such as retirement plans, health savings accounts, or flexible spending accounts to employees to reduce taxable income and attract retain talent.

Inventory Management: Implementing inventory management strategies to optimize tax outcomes, such as using the last in first out or first in, first out inventory costing methods to minimize taxable income.

Research and Development Tax Credits: Maximizing R&D tax credits available for qualifying research and development activities . companies engaged in innovation and technology development may be eligible for significant tax incentives to offset R&D expenses.

Tax planning strategies in india

Tax planning strategies

- Entity Structuring: Choosing the appropriate legal structure for businesses to optimize tax treatment. this may includes selecting between sole properietorship, partnership, corporation or LLC, considering factors such as liability protection and tax implications.

- Tax Loss Harvesting: Offsetting capital gains by selling investments that have experienced losses, there by reducing overall tax liabilities. This strategy involve strategically selling investments to generate losses that can be used to offset taxable gains.

- International Tax Planning: Structuring business operations and investments to minimize taxes in different jurisdictions, considering tax treaties, transfer pricing regulations, and foreign tax credits.

- Retirement Planning: Utlilizing retirement savings accounts such as IRAs, or pensions to defer taxes on contributions and earnings until retirement. contributions to these accounts may be tax deductible, reducing current tax liabilities.

- Investment Planning: Structuring investment portfolios to minimize taxes on investment income and capital gains. strategies may include investing in tax efficient vehicles such as retirement accounts, municipal bonds, or tax advantaged accounts.

- Tax planning strategies

Look out our most viewed articles Investment Strategies for innovative people