Tips for Saving on Insurance Premiums

Saving on Insurance premiums doesn’t have to be complicated.

Here are some tips that can help you save money on your Insurance.

Compare Rates: Get quotes from different insurance companies to find the best price for the coverage you need

Bundle Policies: buying multiple insurance policies from the same company, such as home and auto insurance, can often get you a discount.

Increase Your Deductible: The deductible is the amount you pay out of pocket when you make a claim. Choosing a higher deductible can lower your monthly or annual premiums.

Drive Safely: Safe driving can help you avoid accidents and traffic violations, which keeps your insurance rates.

Review your Policy: Check your insurance policy every year to see if you can lower your premiums by adjusting your coverage. Make sure you aren’t paying for coverage you no longer need.

Pay Annually or Semi-Annually: Paying your Premiums in one lump sum instead of monthly can sometimes lead to savings.

Use Safety and Security Features: Installing safety features in your home, such as smoke detectors, or in your, car, such as anti-theft devices can lead to discounts.

Ask About Loyalty Discounts: Staying with the same insurer for a long time can sometimes get you a loyalty discount.

Look for Discounts: Many insurers offer discounts for things like having a clean driving record, being a good student, or having safety features in your home or car.

Consider Usage Based Insurance: Some insurers offer policies on how much you drive or use your car if you drive infrequently or safely, you may save money.

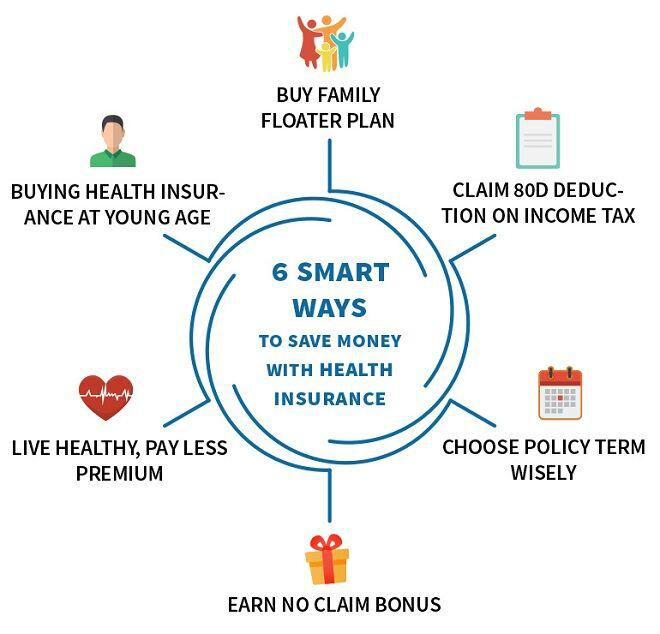

Tips for Saving on Insurance Premiums in India

Saving on insurance premiums in India can be beneficial for your budget.

Here are some tips to help you lower your insurances costs:

- Bundle Insurance Policies: Combining multiple insurance policies, such as health, auto, and home insurance, with the same provider can lead to discounts.

- Maintain a Good Driving Record: Safe driving can help you avoid accidents and traffic violations, which can keep your auto insurance premiums low.

- Opt for Long Term Policies: Choosing long term insurance policies, such as multiyear auto insurance, can often get you a discounted rate.

- Stay Healthy: For health insurance, leading a healthy lifestyle can result in lower premiums. Avoid smoking, maintain a healthy weight, and participate in regular exercise.

- Review Your Coverage Annually: Reevaluate your insurance needs periodically. Adjust your coverage based on your current situation to avoid paying for unnecessary coverage.

- Compare Insurance Providers: Get quotes from different insurance companies to find the best premium rates. Use online comparison website to make the process easier.

- Opt for Higher Deductibles: Increasing your deductible, the amount you pay before the insurance coverage kicks, in can lower your premiums. Choose a deductible you can afford in case you need to make a claim.

- Pay Premiums Annually or Semi-Annually: Paying your premiums in a lump sum instead of monthly can sometimes lead to savings.

- Choose the Right IDV for Auto Insurance: For car insurance, the Insured Declared Value (IDV) of your vehicle determines your premium. Set the IDV close to your car’s market value to avoid over paying on premiums.

Extraordinary Features of saving insurance premiums in India:

Seek Financial Advisor Guidance: Consult with a financial advisor who understand the insurance market in India to find opportunities for premium savings and the most suitable policies for your needs.

Choose The Right Policy: Opt for insurance policies with features that match your needs exactly, without unnecessary adds on. Customizing your coverage can help you avoid paying for services you don’t need.

Group Insurance: If you’re employed, your company may offer group health insurance or other types of group coverage. These group plans can often come at lower premium than individual policies.

Health Insurance Dos and Don’ts

When it comes to health insurance, making informed decision and avoiding common pitfalls is essential to ensuring you have adequate coverage for your needs.

Here are some DO’s and Don’ts,

Health Insurance Do’s:

Do compare Plans: Look at multiple health insurance plans from different providers to find the best coverage for your needs and budget.

- Do Use Preventive Services:

Take advantage preventive care and wellness programs covered by your policy.

- Do Keep your Policy Documents:

Store Your policy documents and receipts safely for future reference.

- Do Check for Waiting Periods:

Some policies have waiting periods for certain treatments or pre-existing conditions .Make sure you understand these limitations before purchasing a plan.

- Do Understand Your Policy:

Read your policy carefully to understand what’s covered, what’s not, and any exclusions. Be clear on terms like copayments, deductibles, and out of pocket maximums.

- Do consider Network Hospital:

Choose a plan that includes network hospitals an doctors that convenient for you make sure your preferred healthcare providers are in network to avoid high out of network charges.

- Do Review Coverage Annually:

Your health needs may change over time, so review your policy annually to ensure it still meets your needs.

Do Stay Healthy:

Maintain a healthy lifestyle can help you avoid medical issues and keep premiums low.

Health Insurance Don’ts:

- Don’t Ignore the Fine Print:

Don’t just focus on the premium cost, pay attention to policy details, exclusions, and coverage limits.

- Don’t Assume All Treatment are Covered:

Verify coverage for specific treatments, medications, or therapies before proceeding.

- Don’t Forget to Update Your Information:

Keep your insurer updated with any changes in your personal information, such as address or contact details.

- Don’t Delay Claim Submissions:

Submit claims as soon as possible to avoid delays or denials.

- Don’t Rely Solely on Employer Coverage:

If you lose your job, you may lose your health insurance. Consider other options such as COBRA or individual plans.

- Don’t Underestimate Coverage Needs:

Avoid choosing the cheapest plan without considering your health needs and the coverage offered.

Common Mistakes:

- Choosing Cheapest Plan: Opting for the lowest premium plan without considering the coverage can result in high out of pocket cost later.

- Failing to Compare Plans: Not shopping around for health insurance can mean missing out on better options.

- Not Knowing Policy Limits: Failing to know your policy’s limits can lead to unexpected expenses.

- Overlooking Preventive Services:

- Neglecting preventive care included in your policy can result in untreated issues and higher costs later.

Why NRIs should their lives with Indian Insurance

Non Resident Indians(NRIs) often have unique needs when its comes to financial planning and securing their lives with insurance. While many NRIs may have access to insurance products in the countries where they reside, there are several reasons why securing their lives with India insurance can be beneficial.

- Beneficiary Flexibility: NRIs can name beneficiaries in India, ensuring that their loved ones receive financial support in case of their demise.

Currency Flexibility: Securing insurance in India allows NRIs to hold assets in India rupees, providing currency diversification. This can help manage exchange rate risks and balance their global financial portfolio. - Long Term Financial Planning: Indian insurance policies can be part of an NRI’s long term financial plan. Policies such as whole life insurance can provide lifetime coverage and can be used as a financial tool for future

- Support Indian Economy: Investing in Indian insurance can contribute to the growth and development of India’s insurance sector and overall economy.

- Ease of Management: Indian Insurance policies can often be managed online, making it convenient for NRIs to handle their policies from abroad.

- Health Insurance for Visit to India: NRIs visiting India can be benefit from having Indian health insurance for their trips. This can help them access quality healthcare and avoiding high out of pocket expenses during their stay.

Look out our most viewed articles: Tax Planning Strategies Dynamic way